Europe’s Hotel Industry Reports Positive Results

Finscoms looks at the latest information, analysis, and reports to correlate a picture of Europe’s hotel sector 2019 performance so far and outlook.

Finscoms looks at the latest information, analysis, and reports to correlate a picture of Europe’s hotel sector 2019 performance so far and outlook.

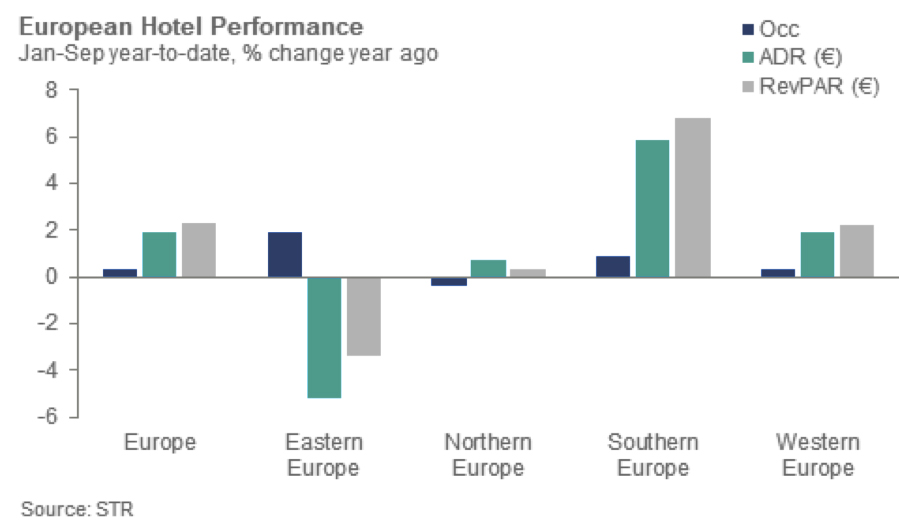

Overall, Europe’s hotel industry reported positive results across the three key performance metrics during Q3 2019, according to data from hotel industry trend analysts STR. Q3 2018 vs Q3 2019 hotel occupancy in Europe Q3 2018 vs Q3 2019 rose 0.6% to 79.1% in the third quarter while Average Daily Rate (ADR) increased 1.1% to €121.36 ($134.97) and Revenue per Available Room (RevPAR) rose 1.7% to €95.95 ($106.71).

Based on year-to-date data to September, STR report that hotel accommodation performance in Europe was relatively positive across all regions. Occupancy rate growth has been relatively subdued as expected, albeit against a backdrop of higher average daily rates compared to the same period last year leading to 1.7% growth in European RevPAR. This growth comes despite concerns of slowing global demand and the fact that the European hotel sector has been able to grow ADR and occupancy presents a rather positive picture.

Based on year-to-date data to September, STR report that hotel accommodation performance in Europe was relatively positive across all regions. Occupancy rate growth has been relatively subdued as expected, albeit against a backdrop of higher average daily rates compared to the same period last year leading to 1.7% growth in European RevPAR. This growth comes despite concerns of slowing global demand and the fact that the European hotel sector has been able to grow ADR and occupancy presents a rather positive picture.

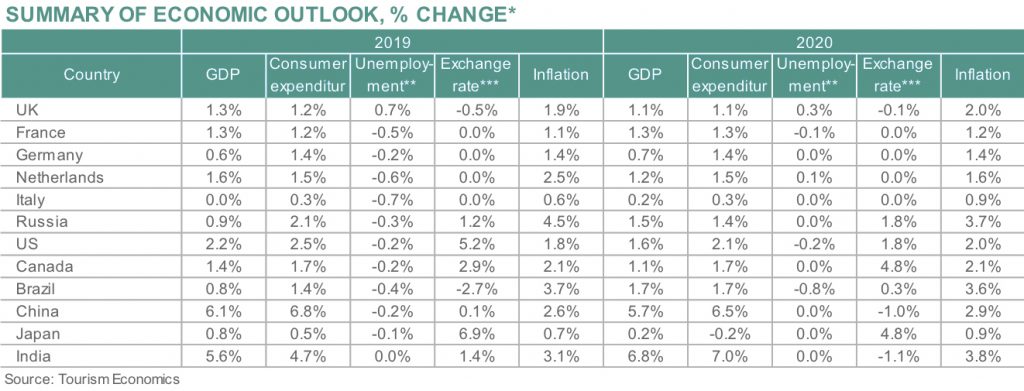

As reported by the World Tourism Organization (UNWTO) international tourist arrivals to Europe were up 4% halfway through 2019 compared to the same period in 2018, in defiance of a slowing global economic environment and associated risks. Economic outlook summary below;

The European Travel Commission’s (ETC) latest quarterly report for Q3 2019 also states that European tourism demand remains in positive territory, notwithstanding a slower expansion rate compared to the previous two years. External risks remain for now but destinations continue to grow at a modest pace and the predominant regional outlook remains positive.

The European Travel Commission’s (ETC) latest quarterly report for Q3 2019 also states that European tourism demand remains in positive territory, notwithstanding a slower expansion rate compared to the previous two years. External risks remain for now but destinations continue to grow at a modest pace and the predominant regional outlook remains positive.

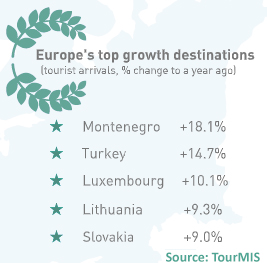

The ETC report highlights Europe’s top growth destination and Montenegro has maintained growth momentum at 18% as it welcomed a rising influx of Western European holidaymakers. In Turkey the depreciation of the lira continued to play a vital role in its tourism performance with an equally impressive 15% increase in tourist arrivals. Eduardo Santander, ETC Executive Director said: “this latest report highlights that travel demand in Europe is in a good place, with steady increases in tourism numbers across the board. Despite very real challenges, such as the looming threat of a ‘no deal’ Brexit, and the collapse of several airlines, European destinations continue to post healthy rates of arrivals, which of course is to be welcomed. Meanwhile, European tourism needs to focus on developing long-term sustainable management solutions to enable tourism to flourish, rather than just merely grow.”

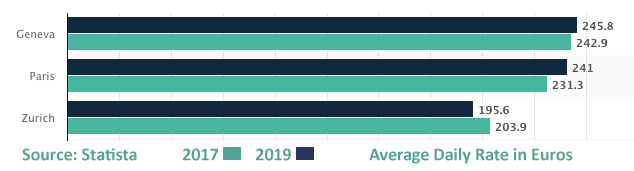

According to Statista, Paris and Zurich remain a league ahead of others with respect to ADR and RevPAR. Swiss cities have some of the highest hotel rates in Europe, although this is in part due to Switzerland’s elevated economic situation. Occupancy rates are relatively high in Zurich and Geneva but London and Amsterdam had the highest occupancy rates of the main European destinations. The two Swiss cities earned the highest revenue per available room, with Geneva on par with Paris.

American and Chinese tourists continue to visit Europe Destination

Understandably, intra-regional demand plays an important role in increasing tourist numbers in Europe, large long-haul source markets continue to make a substantial contribution. Visitors from the US are taking advantage of the strong dollar against many other currencies. Interestingly the ETC Q3 report illustrates that several European destinations are witnessing increased arrivals from the US with significant interest in South-Eastern Europe (Turkey (+32%), Greece (+21%), and Cyprus (+27%)).

Regarding Chinese tourists, the ETC describes the continuation of a strong demand amid a relative decline in the economy with almost all destinations seeing an upsurge in Chinese arrivals or overnights (or both).

The Likely Effect of Brexit for the London Hotel Sector

The ETC quarterly reports the combination of the economic and non-economic factors associated with a ‘no deal’ Brexit would result in a 7% drop in UK outbound trips in 2020 and an 8% drop in 2021, relative to baseline projections. More pointedly, the report states that a ‘no deal’ Brexit would have a long-lasting downward effect on UK outbound travel numbers. The falling value of sterling has seen many UK tourists assessing the benefits of a staycation.

The fall-out of this reduced UK outbound travel will not, however, be experienced evenly across European destinations. Spain will be the most affected European country per traveller volumes with an estimated 1.3 million fewer UK arrivals to the country in 2021 relative to baseline projects. After Spain it is suggested by the ETC that Ireland will be the next the most impacted in percentage terms (-5%) in 2021.

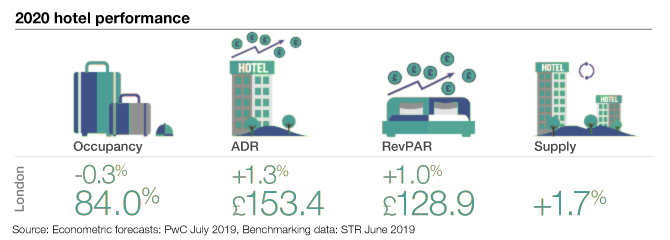

In London, PWC’s UK Hotels Forecast 2019-2020 asserts modest growth next year, buoyed by international tourism. PWC expect London will hold on to growth for the rest of 2019, which is an impressive achievement considering the persistent supply of new rooms. Maintaining the growth will be more difficult in 2020. PWC anticipate occupancy growth to slip into negative territory in 2020, however they still forecast 1% growth in RevPAR.

A portion of PWC’s supposed incremental growth forecast for 2020 in London is driven by ADR uplift from the Farnborough International Airshow, as well as football demand from the seven UEFA Euro 2020 games (including the final) at Wembley. The weak pound should also continue to reinforce leisure demand.

With occupancy levels just over 84% this year, PWC expect a marginal decline of -0.3% in 2020, to 84%. 2019 will see around 2% ADR growth to £151.5. In 2020, it is expected by PWC that rates will grow 1.3% to £153.4. Combined occupancy and ADR drive 3% growth in RevPAR in 2019 to £127.7. A further 1% growth in 2020 pushes up RevPAR to £128.9.

Record levels of occupancy and ADR will ensure London RevPAR reaches new heights. It is an extraordinary performance against high supply additions and only demonstrates “why London is the darling for many investors, owners, operators and brands.” (PWC’s UK Hotels Forecast 2019-2020).

The general consensus for the European hotel sector is that it is robust and resilient despite the backdrop of global economic uncertainty. Please sign up below for our next quarter review of the hotel market.

Ken Carmody COO