Article written by Ken Carmody.

Lithium is an essential material for the production of the batteries used for electric vehicles and energy-storage systems. These lithium-ion batteries are vital as the world moves away from fossil fuels to a greener model. There is now an insatiable appetite for green energy across the globe and our capacity to deliver is currently a critical challenge.

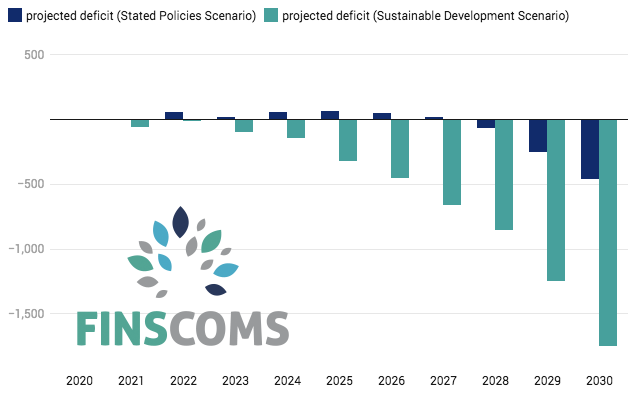

Our planet has sufficient Lithium to meet demand but it isn’t being extracted and refined quickly enough to match the current surge in demand for lithium-ion batteries. By 2030, there’s projected to be a lithium deficit between 455,000 and 1.7 million metric tons each year.

As a result lithium prices are rising significantly. Battery costs continue to drop as other component parts are produced in mass but rising lithium prices will impact on battery cells costs in the medium term. Essentially, the industry is dealing with a structural shortage as there’s literally not enough capacity in the industry to meet demand. And that squeeze is now being felt and will continue to get tighter until Lithium Mining investment reaches the right levels.

There is a disconnect within the electric vehicles supply chain that being the mismatch between the timeline of building a lithium mine versus building the complimentary Gigafactory…>5 years vs 1 year. Much of the Electric Vehicle producers goals and targets set for 2026-2030 will miss as they have not factored in a Lithium supply bottleneck. Based on this, you will start to see a trend of automaker announcements based around the opening of a battery plant along with a new mine. Lithium-ion battery powered EVs are set to dominate the world (as long as Lithium Mines can keep pace).

Contact Finscoms for information on Lithium Mining investment opportunities. MKT@FINSCOMS.COM