Kelp forests like a recently protected site off the Sussex coast sequester 35x more carbon than a rainforest by area.

Article written by Tim Montagu.

A stroll through Covent Garden a few weeks ago was disrupted by an Extinction Rebellion protest which has turned attention to law firms and financial services. Their reasoning is that the city of London is the ‘arch financier of the carbon economy supporting 15% of global carbon emissions’. Whilst the rationale for 15% could be debated, it is clear that as a global financial centre, UK regulators and companies should all be striving to influence a low carbon future both in their own operations but more importantly, for their clients regardless of location.

Most professional services firms now have an ESG policy statement a click or two away from the front page of their website. These highlight the carbon emissions from their own buildings, energy supply and people. Accounting for the emissions of clients in receipt of professional advice is rare, whereas banks or investment funds accounting for a % of emissions proportionate to the financing they provide is much clearer cut and becoming expected in the market. Green finance products that offer a few basis points off the price of already cheap debt for clients hitting self-generated targets is insufficient compared to their carbon impact or the scale of the challenge reduce emissions.

Law Students for Climate Accountability is a US action group that claim ‘top law firms conduct 5-10X more work to exacerbate climate change than mitigate it’. They scored the top 100 US law firms on the three areas where lawyers typically engage with the fossil fuel industry – lobbying, financial transactions and litigation to prevent (or support) climate accountability. This kind of scrutiny is much needed and will surely follow for UK firms who should be cautious on how they represent carbon and resource intensive companies.

The obvious defence here is that it is better to be a professional advisor guiding the client towards a greener net-zero future, than it is to allow a deal to proceed with a less environmentally minded competitor. The same logic applies for UK arms sales to other nations; in theory we have a say in how weapons are used. Unfortunately, this logic only holds if the supplier has a clear, consistent and publicly accountable policy containing sufficient carrots and sticks to guide the client to more virtuous behaviour.

Lawyers, accountants and consultants have a key part to play in enabling companies to be more sustainable, these include;

- helping clients identify, track and report on carbon emissions now required by regulators and initiatives like the Task Force on Climate-Related Financial Disclosures (TCFD)

- assisting with climate risk stress testing mandated by regulators

- supporting compliance with environmental regulation

- developing policies and procedures for assessing climate risks to workforce, assets, operations and transactions.

- helping identify new commercial ventures enabled by the demands of a more environmentally conscious client.

Progress towards all firms tracking and disclosing their carbon emissions is gathering pace. Over half of UK top 100 law firms for example have signed up to the Legal Sustainability Alliance, adhere to ISO 14001 environmental management regulations and have ‘science-based targets’ (SBTi) in order to be net zero[1] or the less stringent carbon neutral[2] by 2025 or 2030. Smaller firms typically have more ambitious and imminent targets in light of their smaller office footprint. Finding a law firm openly stating it will be selective on clients based on their environmental credentials is a challenge.

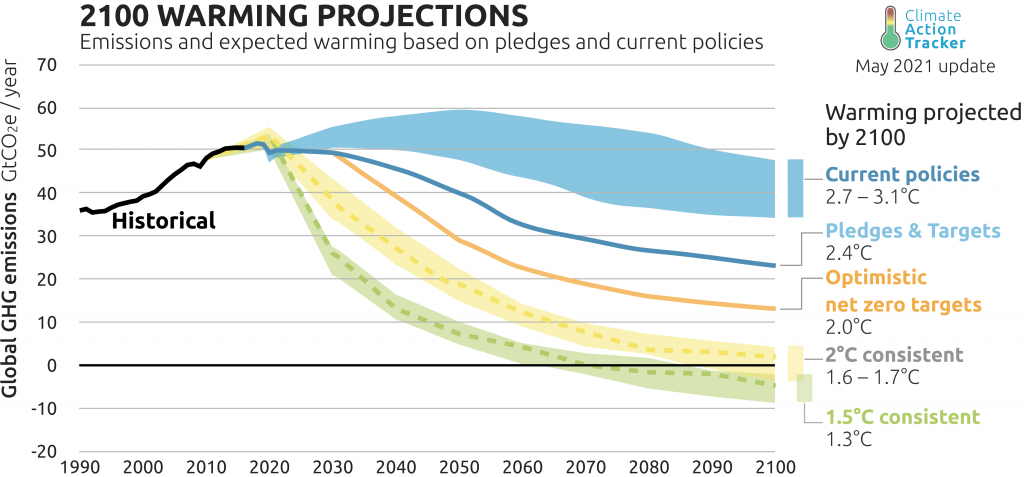

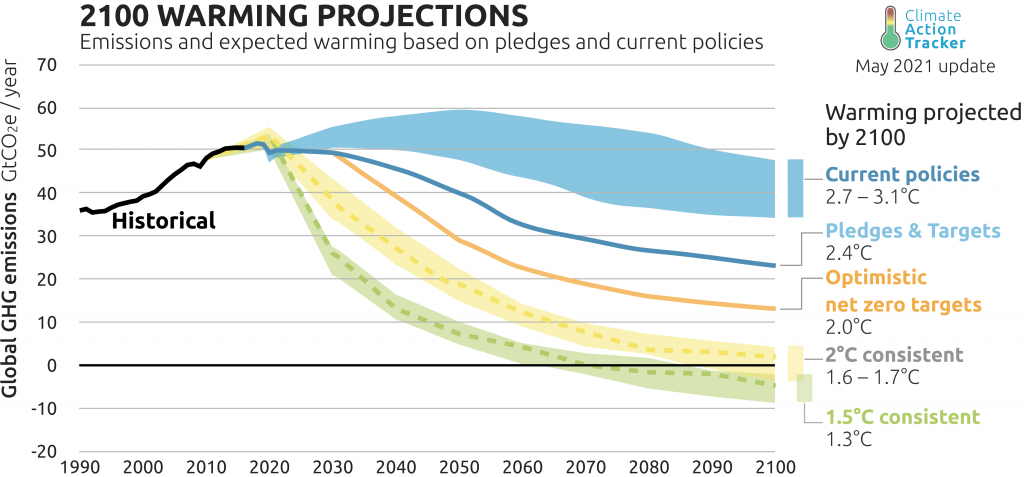

The scale of the challenge to limit global warming is stark. Covid caused 2020 emissions to drop 5.6% or 1.9 Gt CO2. However strong recovery in 2021 shows emissions likely back to 2019 levels in 2023.

For audit and advisory firms, it is easy to envisage the carbon credit market becoming as complex and profitable as financial accounting is currently. Carbon offsetters will need their tree plantations, kelp forests or other sequestration sites monitored. This will create rural employment financed by big corporations assisting the much-needed economic rebalance. No doubt there will be audit scandals where carbon off-setters start double charging for their credits but at least the ‘corporate carbon’ link is being forged.

In any event, the scale of change needed to reach net-zero or carbon negative[3] requires advisors and financiers to be bold and environmentally principled. If a policy is clear and consistent, a small number of missed opportunities will likely be far outweighed by new sales to clients identifying with a firm’s environmental vision and purpose.

Finscoms is able to conduct research, create and implement environmental policies and web content for professional services firms wishing to be progressive on sustainability.

Thank you for reading, do get in touch. tbm@finscoms.com

[1] Net Zero: Company reduces emissions across all activities as much as possible and then offsets any emissions they do produce. This is more stringent than neutrality alone.

[2] Carbon Neutral: Any carbon released to the atmosphere is balanced by the same amount removed by buying carbon credits or offsetting by schemes like reforesting or kelp seeding. Neutrality does not commit a company to reducing its emissions, they just have to pay to offset them.

[3] Carbon negative: The most ambitious commitment by removing more carbon than the firm produces, therefore actively helping the planet. This is also called carbon positive and was in 2020, pledged by Microsoft by 2030.