What are the resilient assets in this Covid19 crisis?

As the World attempts to contain Covid-19 and hinder global escalation, markets have recalibrated in the face of a potential global recession whilst monitoring the shocks to supply and demand. Market sentiment is that we will see virus case escalation in the second quarter with cases rising until May. The subsequent months will see significant disruption to supply and demand before a rebound later this year.

As the World attempts to contain Covid-19 and hinder global escalation, markets have recalibrated in the face of a potential global recession whilst monitoring the shocks to supply and demand. Market sentiment is that we will see virus case escalation in the second quarter with cases rising until May. The subsequent months will see significant disruption to supply and demand before a rebound later this year.

For this rebound to occur, first we would have to see a substantial decrease in fatalities within red zones, and a slowdown in new cases across all major economies. Central banks would need to implement emergency interest rate cuts and coordinate to keep lending channels operating (the Federal Reserve has already made cuts and ECB’s TLTROs are set to be sub-zero), stimulus plans at national and international levels introduced (e.g. ECB’s €750billion Eurozone financial package and the US administration are to sanction more than $1trillion) and other fiscal authorities to bring about quantitative easing measures. These measures are intended to avoid a more dramatic scenario where the health problem will be followed by a severe economic recession with two or more consecutive quarters of negative growth and potentially thousands of bankruptcies. The indication is that once business resumes then the economy should see a speedy, sharp recovery. Fundamentally, periods of stock market corrections are often followed by markedly positive trends within six months of finding the bottom. Volatility in the meantime of course will be high.

What can investors proactively do?

So, we should expect low growth and low interest rates into the second quarter and possibly the third quarter. There has already been a brutal repricing of assets so many are not from this point adopting a defensive stance feeling that the damage has already been done. Some sectors will prove to be more resilient, namely infrastructure and real estate, certain commodities may also perform well.

Infrastructure – typically regarded as a solid defensive investment with above average dividend yields. The benefit being that this sector is usually involved in long-term contracts often with governments providing reliable cash flows. China is expected to announce fiscal stimulus packages for infrastructure. Telecommunication towers should continue to see decent secular demand along with digital economies particularly those involved in remote office work, remote management tools, and remote networking. More data centres may be built and more fibre optic infrastructure put in place to cope with demand.

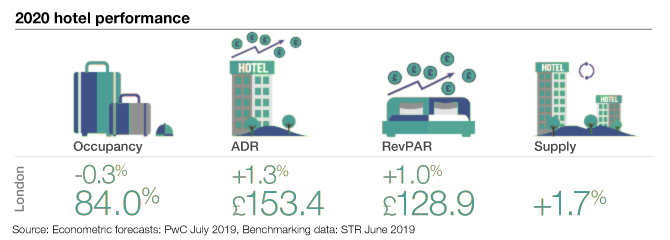

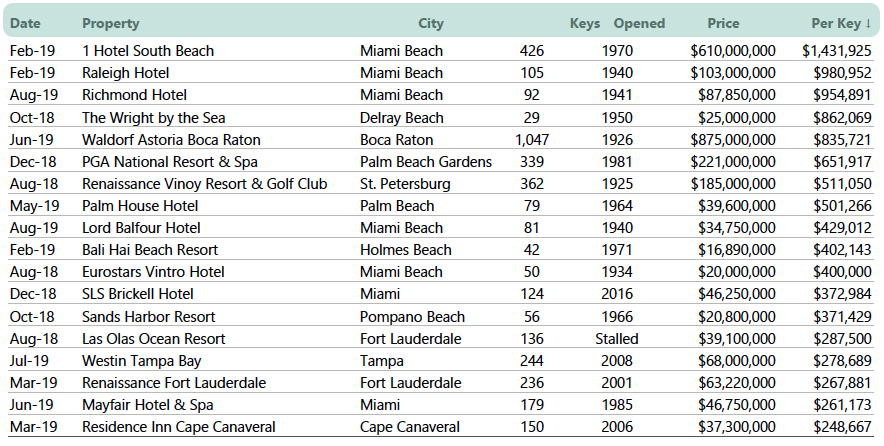

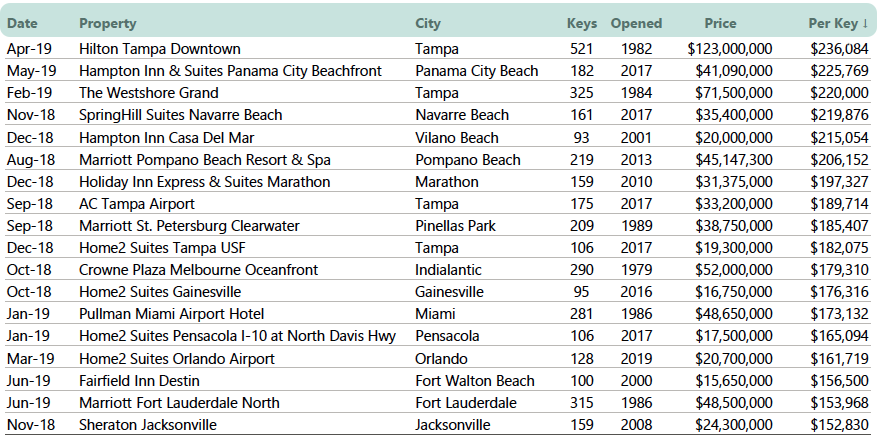

Real Estate – this sector has shown resilience in the past during uncertain economic times. The benefit comes from predictable and stable lease-based cash flow and would not be affected by near-term shocks to the global supply chain. Due to being less impacted by global economic conditions, healthcare, rental housing, net lease, and storage are among the most resilient within this sector. Hospitality will heavily be impacted and opportunities may arise for discounted assets in the coming months. Office demand will have to be reassessed as the confinement/lock down has obliged firms to quickly deploy business continuity plans sending their employees home. Employees will be more accustomed to working from home and even favour it – the individual and business standpoints could be aligned resulting in a decreasing demand for offices.

Commodities – gold of course is the typical safe haven investment. For base metals we know that there is an inventory overhang as demand from China halted. Once Chinese factories resume full operations base metals should recover. China also expected to introduce fiscal stimulus to autos and infrastructure which require vast amounts of base metals. Agriculture is to experience less impact than other sectors as consumption and production rates stay level.

For many this has been a time to restructure their portfolio to a more defensive stance, whilst others have identified great value in the market confident that once Covid-19 is under control by Q3/Q4 major economies will see a rapid recovery. Either way, proactivity means its business as usual despite operating under lock down conditions.

Finscoms helps funds and projects to tell their story to a wider investment network. In these unprecedented times our clients are looking for guidance. We would like to share with you our thoughts. Please contact us to hear about how we can help you.

Benoît Egée, Co-Managing Partner

Connect with Benoît via LinkedIn

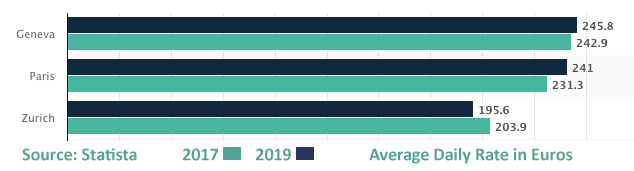

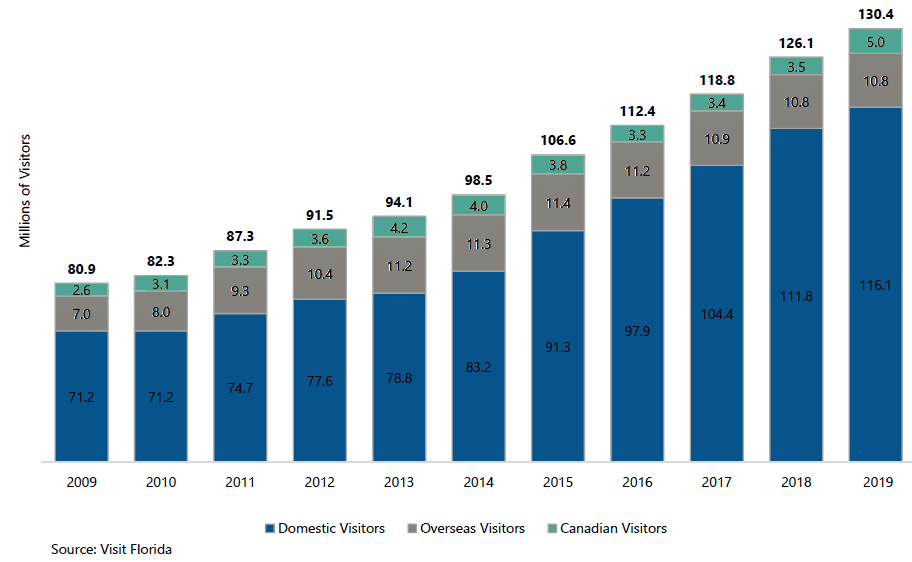

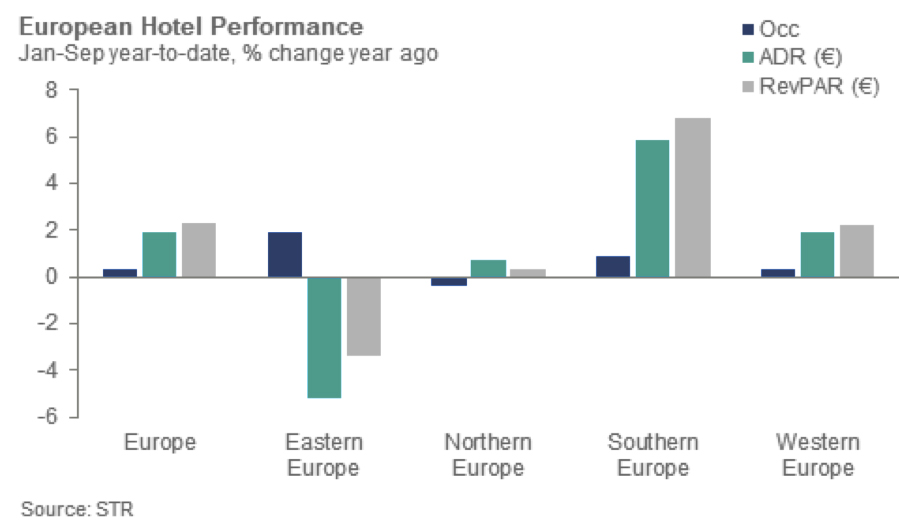

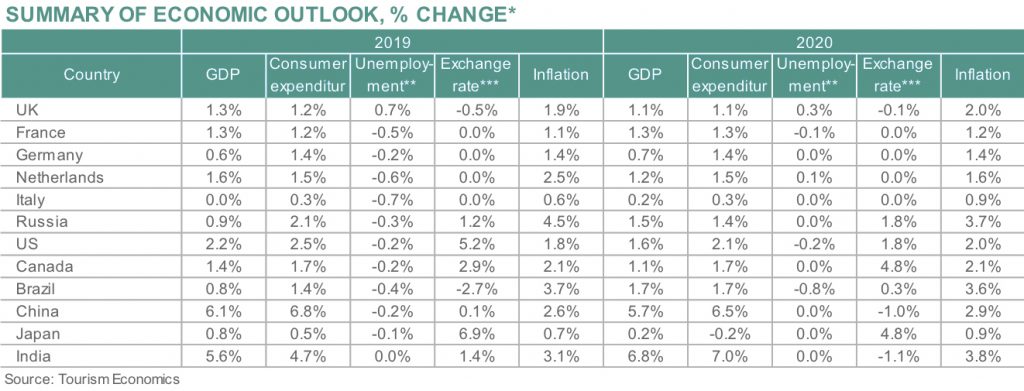

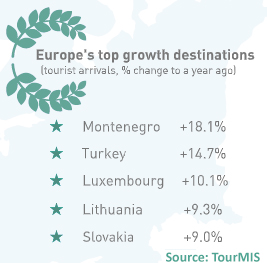

The European Travel Commission’s (ETC) latest quarterly report for Q3 2019 also states that European tourism demand remains in positive territory, notwithstanding a slower expansion rate compared to the previous two years. External risks remain for now but destinations continue to grow at a modest pace and the predominant regional outlook remains positive.

The European Travel Commission’s (ETC) latest quarterly report for Q3 2019 also states that European tourism demand remains in positive territory, notwithstanding a slower expansion rate compared to the previous two years. External risks remain for now but destinations continue to grow at a modest pace and the predominant regional outlook remains positive.