All Assets Under Management Are Exposed to Water Risk

Water risk affects all assets.

By 2025, $145 Trillion assets under management will be either directly or indirectly exposed to financial water risk. Physical and financial water risks are the largest threats to people, planet and profit. All investors need to be made aware of this inherent risk factor.

The threats to water resources are significant; pollution, increasing global population, growing cities demanding more water, power generation, climate volatility, food production requirements, floods, drought etc. Severe droughts have caused billions of dollars of damage in Southern Europe and California and increasingly other parts of the world. Research from the World Bank suggest that since 2001, rainfall shocks have caused a loss of food production sufficient to feed about 81 million people every day for an entire year – equivalent to the population of Germany.

Water is often compared to carbon in terms of growing operational and strategic risk that investors need to account for. However, where water and carbon differ in this regard is that today’s water threats move rapidly i.e. they can lead to significant or total value destruction in a far shorter timeframe. Water security can be converted to water risk overnight. Recent examples include; BHP and Vale facing a $50 billion fine stemming from compensation claims, officials in northern India ordered Coca-Cola Co. to close a local bottling plant amid protests that they were extracting too much groundwater, a Chilean drought has hampered production for the nation’s copper miners, and Newmont delayed a $5 billion mining project in Peru after community protests over water concerns.

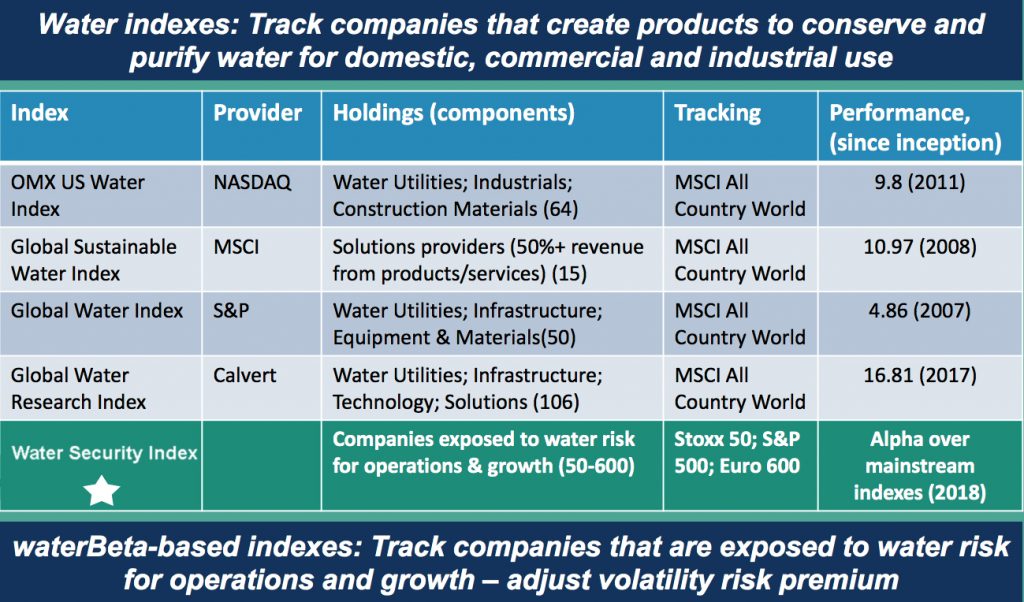

Investors are trying to integrate water risks into their strategies but they are currently using limited data. Our clients seek to bridge the gap by launching a Water Risk Index which will be the first index worldwide to price financial water risk.

The Index tracks corporate management of and action on water security. It informs asset owners, financial institutions and investment managers of the water risk to equities in their financial portfolios. Every security is exposed to financial water risk, which to date has no viable tool or methodology to assess and price this risk.

Ken Carmody.

For more information click here or contact us.