Smart Legal Contracts are the Inevitable Solution

Smart Legal Contracts have the capacity to revolutionise business practice

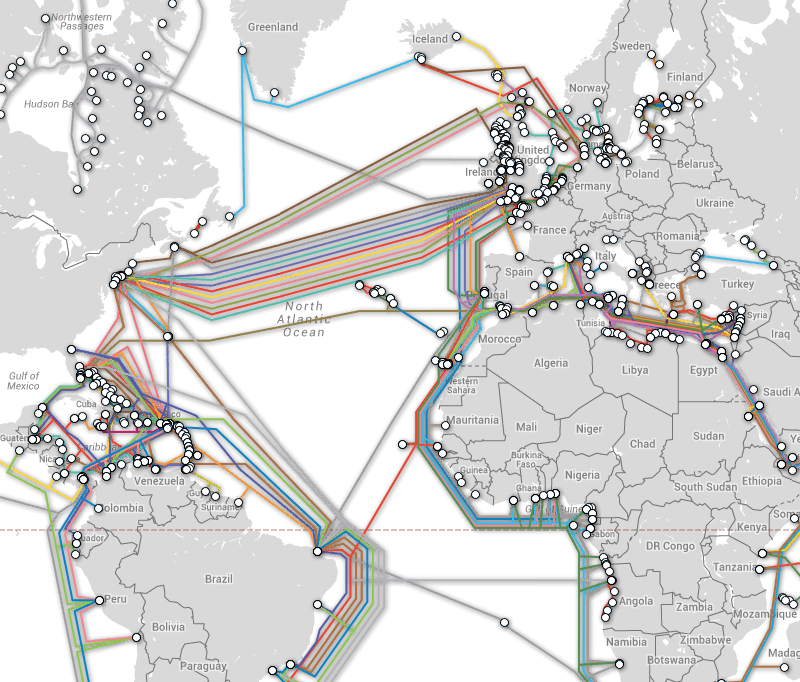

Smart legal contracts are legally binding contracts converted into computer code governing interactions between counterparts and other stakeholders. Consequences decided upon by the contractors will be self-executing when the defined conditions are fulfilled. This innovation will greatly improve business operations for example, large banks face between €4-5Billion in regulation and compliance related fees annually and smart legal contracts will drastically reduce this burden.

Benefits

The smart legal contracts will remove the need for a third party to implement the contracted obligations, which will significantly reduce contractual costs. Alongside of that, the smart legal contracts will provide legal certainty for the parties as the language of code does not allow scope for ambiguity regarding interpretation of the terms. This will have added benefit to international contracts with variation of meanings in different languages, they will now be described in a computer language code instead.

Moreover, smart legal contracts reduce costs and risks by eliminating paper-based processes, enabling complete automation of many business functions. Regarding regulation and compliance, Smart legal contracts will also allow regulations to be incorporated into the computer code along with the contractual agreements to ensure compliance. Smart legal contracts can also integrate production instructions to drive, for example, 3D printers, creating a single computer protocol that governs a production process, compliant with the contract and regulation.

Adoption

Companies that seek a superior position in the market, reduction of transaction costs and more security in the execution of contracts would be wise to explore the use of smart legal contracts. Best in class across many sectors now realise that this is the next level solution and investor interest is rising everyday.

Our client QPQ is one such company pioneering this technology. A spokesman for QPQ said, “The digital revolution has so far been about digitisation; making inefficient processes more efficient. Smart legal contracts are about digitalisation – completely removing those inefficiencies. Our on-going customer discovery programme shows that companies will save more than 9% of annual revenue using this technological breakthrough on our platforms.”

QPQ are developing an enterprise grade trade settlement and digital governance network of unparalleled efficiency, capacity and scalability fit for the 21st Century and beyond. Finscoms as a communication specialist is telling QPQ’s story to the investment community. Contact us to learn more about this opportunity.

Ken Carmody

+353 1295 3844